As we approach the end of 2023 and set our sights ...

Over the past few years, we have seen COVID change the employer-employee relationship and spark the “great resignation.” According to a recent study, 68% of employees those employed in December 2022 plan to look for a new job over the next 12 months.

Over the past few years, we have seen COVID change the employer-employee relationship and spark the “great resignation.” According to a recent study, 68% of employees those employed in December 2022 plan to look for a new job over the next 12 months.

To stop the wave of employee turnover, organizations must focus more than ever on increasing employee engagement. A best practice for businesses to weather the storm is to creatively enhance the employee work experience, design benefits packages that respond to their employee's needs, and take additional steps to attract qualified workers.

The result can be a motivated workforce delivering outstanding customer service.

Organizations must prioritize improving employee morale since it affects many factors, including:

Employees generate more work more effectively when they believe in the objective of the organization and can see themselves growing professionally there.

Employees are inspired and eager to collaborate with other team members on new projects when they feel supported and in-sync with their peers.

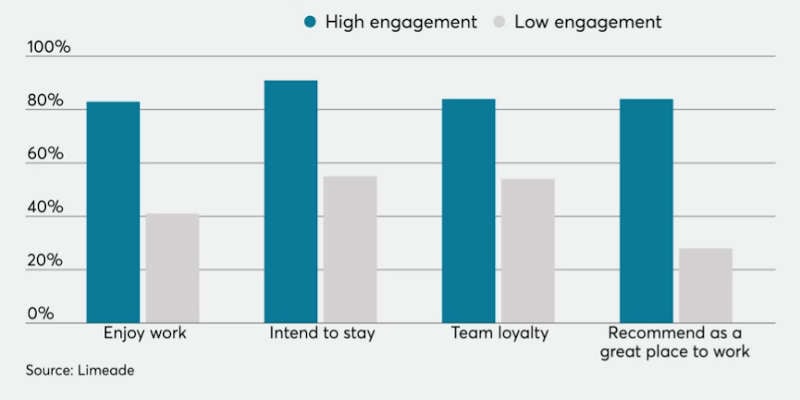

Employees who are engaged in the workplace are more productive and loyal.

Employees who feel valued by their employer are naturally more invested in the work they do and the overall performance of the organization. Simply put, when your people are happy with the benefits they receive from you, they are more engaged.

A strategic compensation and benefits package is always the foundation of any high-performing culture. Employee engagement requires the involvement of the Human Resources (HR) department in any company. One way HR managers can boost engagement is by developing and implementing a comprehensive benefits package.

Create benefits that align with the individual. This will include their social systems, their interests, their work habits, and personal life events. Nutritional counseling, health literacy training, and assistance with personal interests are all options for increasing engagement, and physical and emotional well-being.

Provide the right tools and training. It is critical to encourage productivity and high morale by providing employees with the necessary tools and resources to do their jobs.

Try not to fit all employees into one plan design. Offering flexible benefits or voluntary coverage is a powerful tool that can assist employers in increasing productivity with a healthier, more engaged workforce.

Be creative. Work with a broker who understands how to design an outside-the-box benefits program.

Some of these might be considered benefits while others are general strategies that will impact motivation, morale, and productivity.

Health benefits do not have to be limited to high-quality healthcare coverage. Every year, take a fresh look at the available plans and policies and ask your current employees what they want in a healthcare plan. Many people want more holistic and alternative care options, such as licensed massage therapy and acupuncture, to be available.

Voluntary benefits are services or goods paid for in whole or part by the employee but at a discounted group rate made available by the company. Typical examples include supplementary benefits that lie outside of regular benefit packages, such as financial counseling, ID theft protection, healthy lifestyle programs, pet insurance, and supplemental insurance packages, such as travel, life, or cancer coverage.

In the past, a retirement plan may have been an optional employee benefit, but now it is essentially required for all firms. Top candidates anticipate that employers will provide a retirement plan. They will consider their own and their family's futures.

This last year was dominated by the topic of well-being, and in 2023, companies’ efforts to accept new and expanded well-being resources will be a prominent focus. Benefits packages should include mental health services.

Employers should consider alternative healthcare plans with an open mind and care. These tactics are challenging to execute and, if not managed correctly, could negatively impact employees who prefer standard health insurance. It is essential to consult with a health benefits specialist to maintain low expenses and increase employee satisfaction.

Leap l Carpenter l Kemps Insurance agents and consultants have helped many businesses establish, plan, and implement successful risk management and insurance strategies. Contact us today for more information on the advantages of risk management consulting services or to schedule a consultation with a professional expert.

As we approach the end of 2023 and set our sights ...

Employee benefits will help your small business re...

Paid vacation time, health insurance, tuition reim...

Leap | Carpenter | Kemps Insurance Agency provides Commercial Business Insurance, Employee Benefits, Life and Health Insurance, and Personal Insurance to all of California, including Merced, Atwater, Los Banos, Mariposa, Madera, Fresno, Modesto, Turlock, and Stockton.

CA License Number 0646081 | Licensed to do business in California, Arizona, Hawaii, Idaho, Montana, Nevada, North Carolina, Oklahoma, Oregon, Virginia, West Virginia and Washington.

© Copyright 2023 Leap | Carpenter | Kemps Insurance Agency — Privacy Policy | Terms & Conditions.

Merced Office

3187 Collins Drive

Merced, CA 95348

Phone: (209) 384-0727

Additional Contacts

Toll Free: (800) 221-0864

Fax: (209) 384-0401