Similar to legal malpractice suits, uncovered medi...

If your business operates in the state of California and has employees, then you know you’re required to carry workers’ compensation insurance. But did you know that there is a rating system that can either increase or decrease your annual premium?

This rating system, known as an experience modification or ex-mod for short, can be positive or negative: positive for employers keeping workers’ comp claims minimal, and negative for employers who are having difficulty managing claims. While ex-mod ratings can seem confusing, understanding how they work and how you can improve your rating will save your company thousands of dollars every year.

An Ex-Mod is nothing more than the fancy name for the rating modifier that is applied to your workers’ compensation policy. It exists to incentivize employers like you to maintain a safe workplace.

An Ex-Mod is nothing more than the fancy name for the rating modifier that is applied to your workers’ compensation policy. It exists to incentivize employers like you to maintain a safe workplace.

The Ex-Mod is expressed as a percentage and then used to adjust your company’s Workers’ Comp Premium to reflect its claims or loss history. The base rating is 100% or 1.00, which represents the industry average for each class of business. But depending on your company’s’ claims history, your ex-mod may be a credit or a debit. Any number issued below 1.00 is a credit and anything above 1.00 is a debit.

To understand how a credit mod or debit mod affects your workers’ comp premiums, let’s take a look at two hypothetical situations. First, let’s say that, hypothetically, your company has an experience mod issued at .80. With an Ex-Mod of .80, this means you have a credit mod, and your losses are better than expected. At .80, you earn a 20% credit off of your base rate for each classification on your policy. So if your original workers’ comp premium was $100,000, your credit ex-mod of .80 earns you a new, lower premium of only $80,000.

Going the other way, if you are issued a 1.20 debit mod, it means your losses are worse than expected and you have a 20% debit added onto your base rate. So if your company was paying $100,000 in workers’ comp premiums, your new modified premium is now $120,000.

Here's an example of how this works:

| Premium | Experience Mod | Modified Premium |

| $100,000 | .80 | 80,000 |

| $100,000 | 1.00 | 100,000 |

| $100,000 | 1.20 | 120,000 |

Now that you know your goal is to get to a credit mod, it’s time to understand how to get there.

The California Workers’ Comp Insurance Rating Bureau (WCIRB) is responsible for determining eligibility, calculating, and issuing ex-mods to California employers. The WCIRB issues ex-mods in an effort to compare the losses or claims of a company to all other California companies in the same industry that are similar in size.

The WCIRB seeks to make the ex-mod rating as fair as possible for all employers, which has led to recent changes in both determining eligibility to receive an ex-mod, as well as the formula used to calculate it. The most recent change to determining eligibility came in 2016, using expected losses as an eligibility threshold, instead of the amount of workers’ comp premium generated by a business. What this ultimately means for your company is that you need to fit within the eligibility criteria to receive an ex-mod and get your premiums reduced.

Some employers are unfamiliar with an ex-mod because they’ve never had one, even if they’ve carried workers’ comp coverage for years. This is because companies with employees—and possibly you included—weren’t aware that to receive an ex-mod you need to meet the eligibility requirements to qualify for one.

There are a few different factors that determine whether a business is eligible to be experience rated and issued an ex-mod:

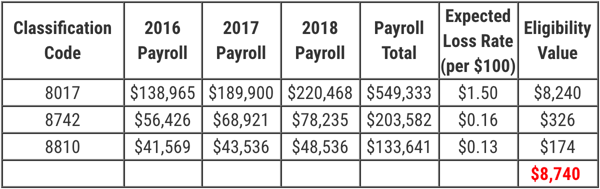

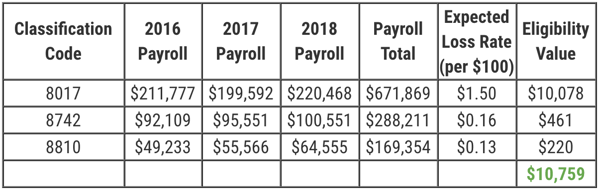

Based on these factors, WCIRB determines eligibility by calculating a company’s value. Using a three-year experience period, audited payroll is totaled for all three years by classification on your policy, with each classification being totaled separately. The three-year total is then multiplied by the expected loss rate for each specific classification. The expected loss rate will vary by class depending on the severity of the code.

Once each class is totaled, they are all added together to make up a company’s eligibility value. The minimum eligibility threshold to qualify for an experience rating is $10,000. If your company meets that threshold, then it will be eligible for an experience rating and issued an ex-mod. Your eligibility threshold will be adjusted annually by the WCIRB. I've provided a few examples from the WCIRB below:

In the WCIRB Table below, Employer 1 does not qualify for experience rating because the eligibility value ($8,740) is below the eligibility threshold of $10,000.

In the WCIRB Table below, Employer 2 does qualify for experience rating because the eligibility value ($10,759) is above the eligibility threshold of $10,000.

For companies that qualify for a rating, the experience mod is mandatory. That means that if your company is eligible, then no matter which insurer provides your coverage, your experience mod will be applied to the policy.

Luckily for you, the formula used to calculate the experience mod has been simplified over the years. The formula itself reads “Actual Primary Losses + Expected Excess Losses, divided by Expected Losses”, but we can break down this jargon into layman’s terms.

Under the formula, the three-year rating period is used to compare actual losses to expected losses for each business. Actual losses are considered to be any medical and indemnity claim costs associated with a work related injury. Expected losses are calculated using the annual average claim costs for a similar size business in the same industry.

Although many factors go into calculating the formula, let’s review the most important. In 2019, the WCIRB made the critical change to eliminate the first $250 of each claim reported, encouraging employers to report all first aid claims.

The WCIRB also uses “split points,” which determine your primary loss threshold. The values range from $4,500 to $75,000, and are determined by the size of your business. Your primary loss threshold is important because it provides a cap on claims that are reported, helping to minimize the impact of one catastrophic claim. For example, let’s say your company has a primary loss threshold of $15,000 and a $50,000 claim. In that case, the amount factored for the ex-mod will only be $14,750. This is because the loss reached the primary loss cap and the first $250 of any claim reported is eliminated. While your total claim amount will show on your ex-mod worksheet, only “actual primary losses” are used in the formula.

Ultimately, your company’s (or that of any employer’s) ex-mod worksheet is a complete breakdown of all exposures, factors, and calculations.

Now that you’ve been inundated with information about ex-mods, you need to know the bottom line: how can you leverage this information to reduce your workers’ comp premiums?

First, remember that your ex-mod is more negatively affected by the frequency of claims and not the severity of claims. This is a critical benefit to all employers because no matter how great your safety program is, there are still unpredictable incidents that occur in the workplace. One large loss in a rating period will have a much lower effect on an ex-mod increasing compared to three, four, or five smaller claims. By being proactive in eliminating preventable incidents (and their corresponding claims), you can significantly improve your ex-mod.

Second, a little known fact amongst agents and employers is that an employer’s ex-mod typically cannot be increased more than 25 points from its loss-free rating for any one claim in an experience period. But it can happen. If you don’t comply with your end of year audit and no payroll is reported for a policy period in the experience period, the rule doesn’t apply.

Here at LCK Insurance Agency, I was able to help a client by showing the client that a 53-point ex-mod increase should not have occurred. Once that was identified, we knocked out the audit from the previous year and were able to have the WCIRB revise their ex-mod. It is extremely important to review your experience mod worksheet each year when it is published to make sure there are no errors. Employers are entitled to one free copy per year that can be requested either by mail or email here.

Whether you’ve done a phenomenal job at managing risk and have a great ex-mod, or haven’t been as proactive and let your mod get away from you, there are always alternative options in the insurance marketplace that you should consider.

Whether you’ve done a phenomenal job at managing risk and have a great ex-mod, or haven’t been as proactive and let your mod get away from you, there are always alternative options in the insurance marketplace that you should consider.

If your company has a great track record of low ex-mod years, it may very well qualify for a group captive program as long as your company is large enough. On the other end, if your company has struggled with claim activity and has experienced consistent increases in its ex-mod rating, it may be well suited for a PEO product that offers extremely hands-on HR consulting and safety training with their program.

As I mentioned earlier, to be able to use your Experience Mod to effectively control costs, you must first understand how it works. The next step is to be proactive and talk to an insurance professional who can help you identify specific areas you can improve on. This is yet one more reason why it’s important to have a trusted insurance agent who can help guide you in the right direction.

Similar to legal malpractice suits, uncovered medi...

You get all the benefits and advantages of being a...

Natural disasters and crimes can impact a business...

Leap | Carpenter | Kemps Insurance Agency provides Commercial Business Insurance, Employee Benefits, Life and Health Insurance, and Personal Insurance to all of California, including Merced, Atwater, Los Banos, Mariposa, Madera, Fresno, Modesto, Turlock, and Stockton.

CA License Number 0646081 | Licensed to do business in California, Arizona, Hawaii, Idaho, Montana, Nevada, North Carolina, Oklahoma, Oregon, Virginia, West Virginia and Washington.

© Copyright 2023 Leap | Carpenter | Kemps Insurance Agency — Privacy Policy | Terms & Conditions.

Merced Office

3187 Collins Drive

Merced, CA 95348

Phone: (209) 384-0727

Additional Contacts

Toll Free: (800) 221-0864

Fax: (209) 384-0401